Welcome to the June edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into the key factors influencing the U.S. economy.

Big Picture: May saw no reprieve from the freight recession with slumps in Memorial Day Weekend demand

- Registrations of new carriers dipped to their lowest levels since June 2020, while carrier exits maintained April levels.

- The top 50 retailers did not increase inventories to support Memorial Day Weekend sales, though “peak season” around July 4 will be a better indicator.

- Despite the ongoing rebalancing, labor disputes on the West Coast bring the threat of renewed supply chain disruptions.

Carrier registrations and exits indicate the freight recession charges on

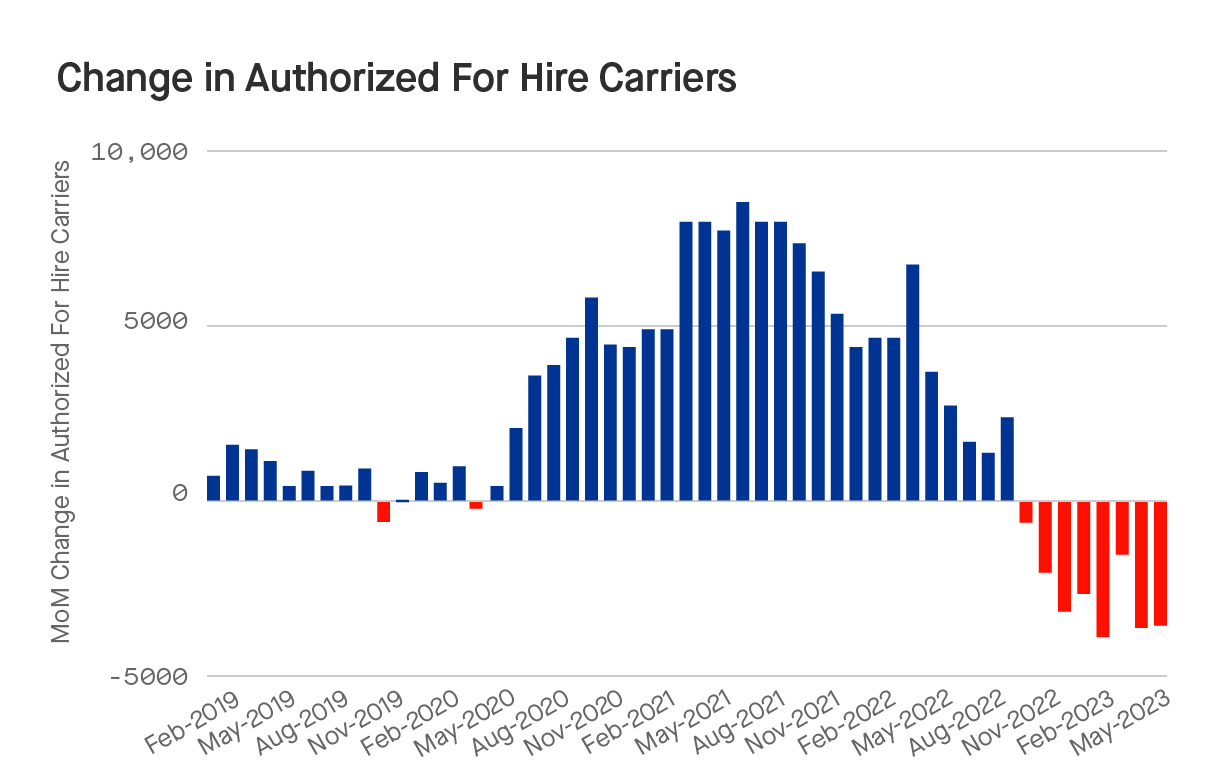

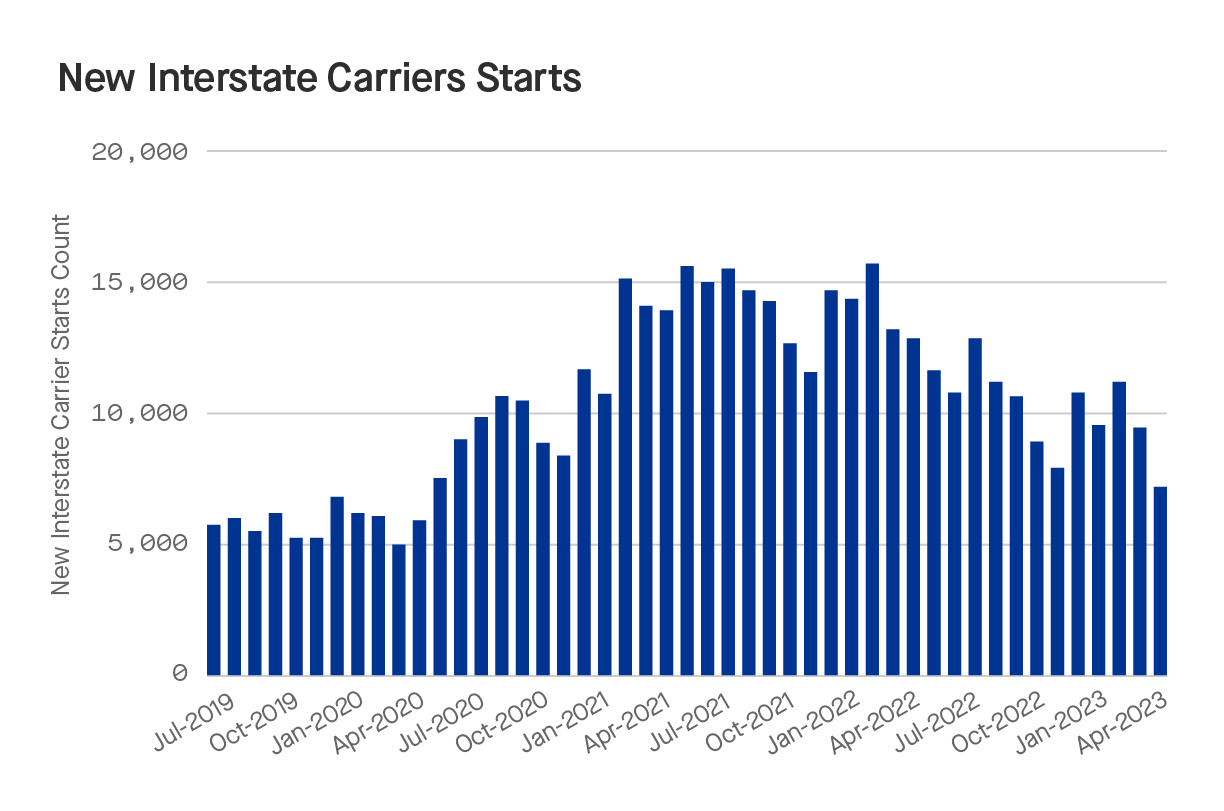

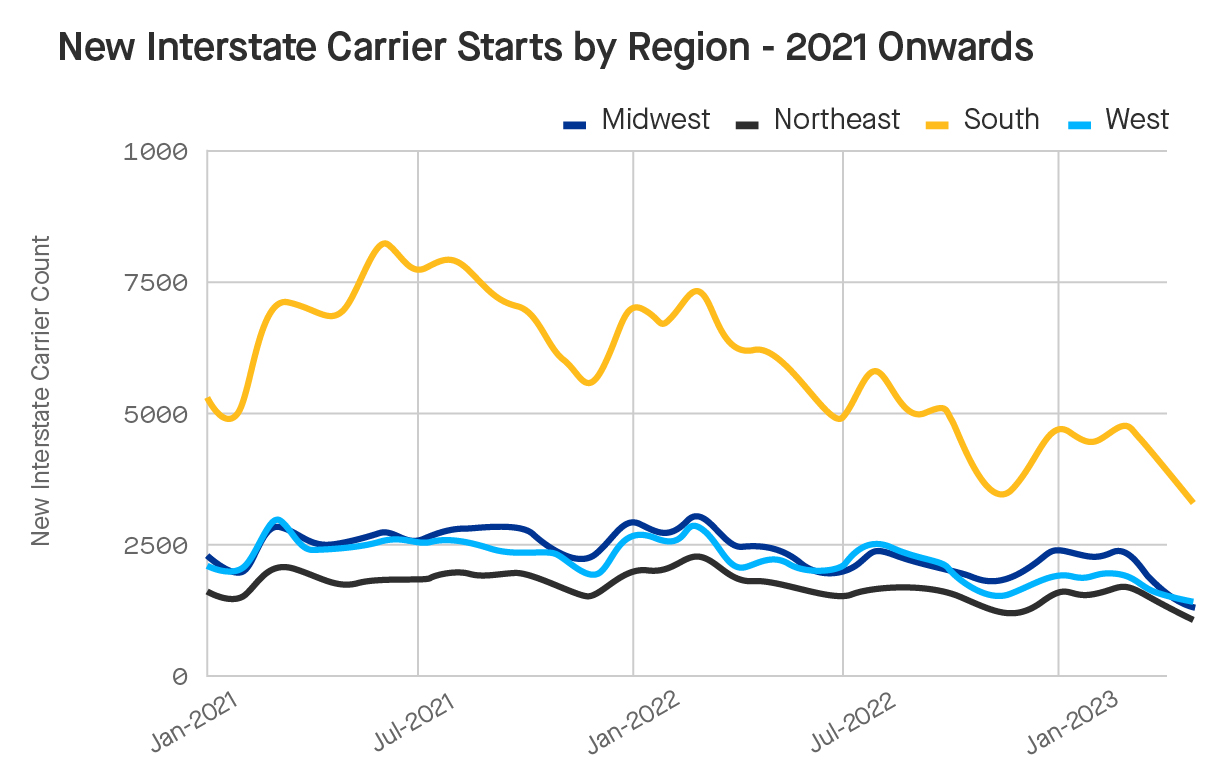

The slowing of carrier exits expected in Q2 has not yet materialized, as May saw 3,500 carriers exit the market, similar to levels seen in April. Meanwhile, there were less than 7,200 new carrier registrations last month. This represents a 22% month-over-month decrease that matches levels last seen in June of 2020, before the pandemic freight explosion. Regionally, the sharpest declines in carrier starts were once again seen in Southern states (down 31% since April 2022). These are being driven by Texas and Florida, which represent 40% of the new company starts.

The freight market’s rebalancing continues

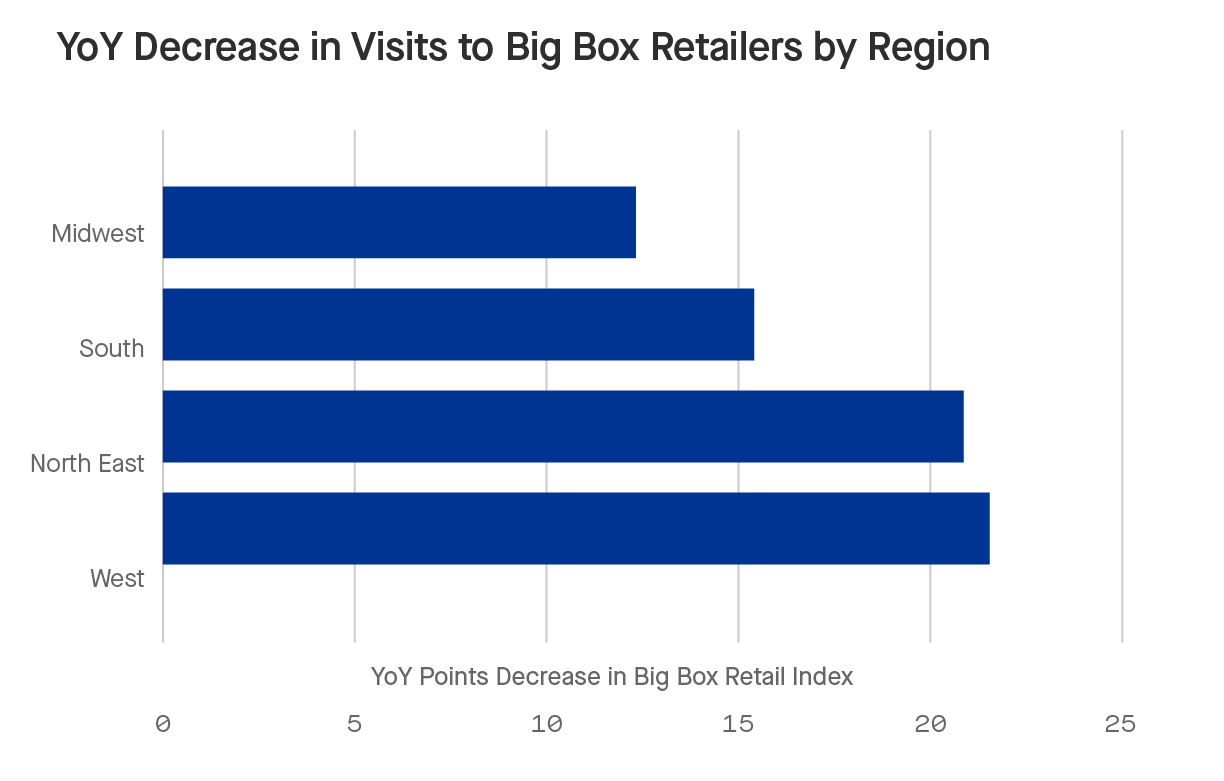

Retailers showed little appetite to increase inventories for the summer, and Memorial Day didn’t see its typical acceleration of traffic in the 2 weeks leading up to the holiday. Memorial Day brought no significant increase in traffic to distribution centers for the top 50 retailers by volume, and retailers in all regions saw lower traffic compared to 2022.

For the moment we have seen no change in sentiment from retailers wanting to increase inventory levels. As in April, the Midwest saw the smallest year-over-year dip in traffic (12%). The July 4th holiday is typically the stronger indicator of inventory strategies for the holiday season, but the May data nonetheless paints a negative picture for freight demand through the first five months of the year.

West Coast port negotiations could spell another supply chain crunch despite demand trends

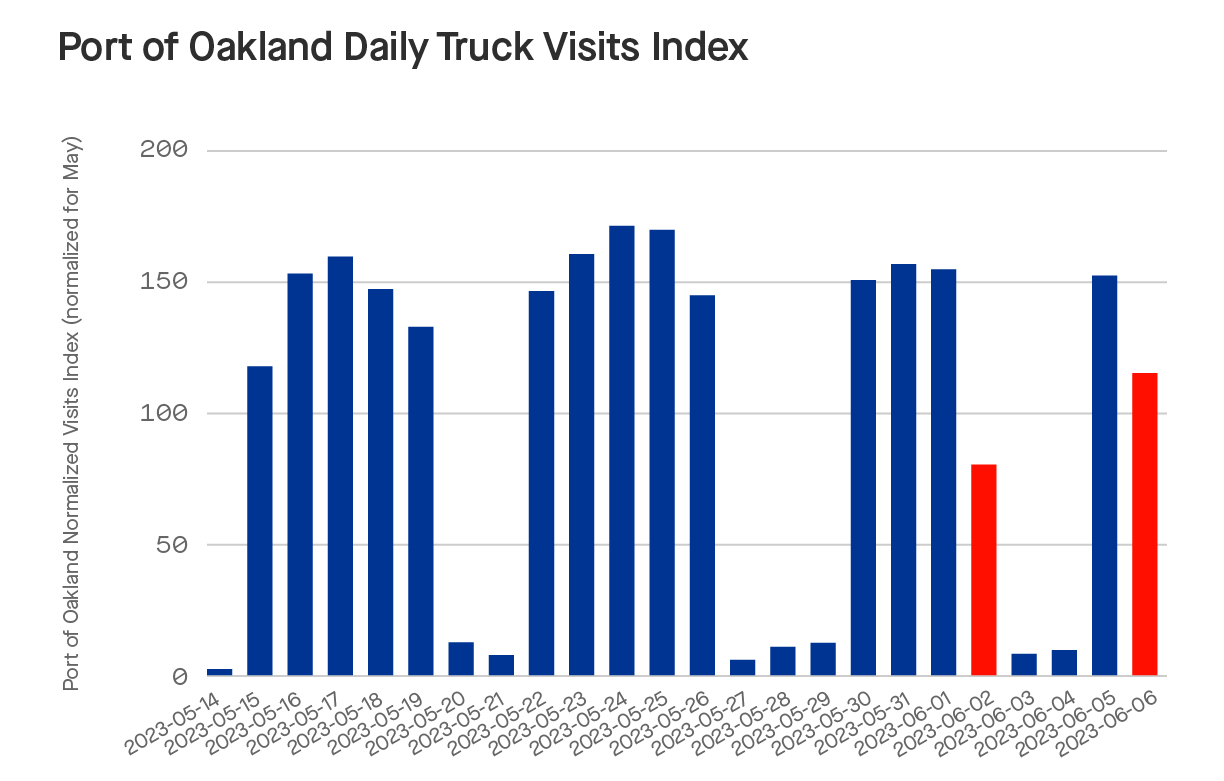

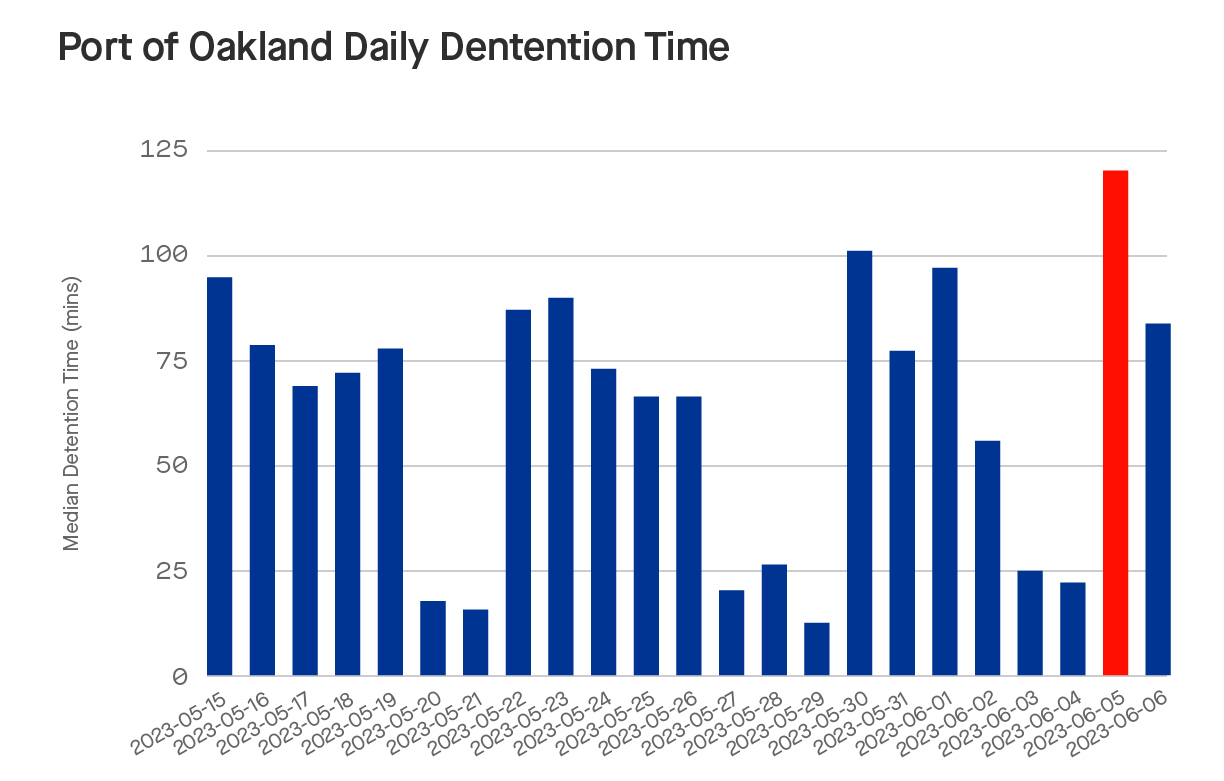

Recent data of daily truck visits at the Port of Oakland offer a look at what labor disputes on the West Coast could herald. The port saw sharp drops in visits on Friday, June 2 (in line with breakdowns in negotiations) and Tuesday, June 6, while Monday, June 5 saw the median wait time for a vehicle at the port rise 30% from a typical Monday. Coupled with an increasing number of ships heading for the West Coast, these occurrences could circumvent current demand trends to create a supply chain crunch.

Key takeaway

It is paramount that carriers plan for scenarios that buck traditional norms (such as seasonal bumps in freight demand) and maintain operational efficiency. Flexibility in both nationwide and local planning can help them weather a freight recession that hasn’t yet shown signs of slowing down. A comprehensive understanding of current trends at various parts of the supply chain is also critical to avoid being caught flat-footed.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration and U.S. Department of Transportation.