Welcome to the May edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into the key factors influencing the U.S. economy.

Big Picture: Freight recession or reversion to the mean? Early signs indicate a return to pre-pandemic norms.

- The trucking industry is rebalancing, with some regions experiencing bigger drops in carrier exits.

- Southern states like Texas and Florida have seen the most losses, but this may be a return to normal following their 2021 growth.

- Overall, the freight market is shrinking, but new companies are still forming in line with six-month averages.

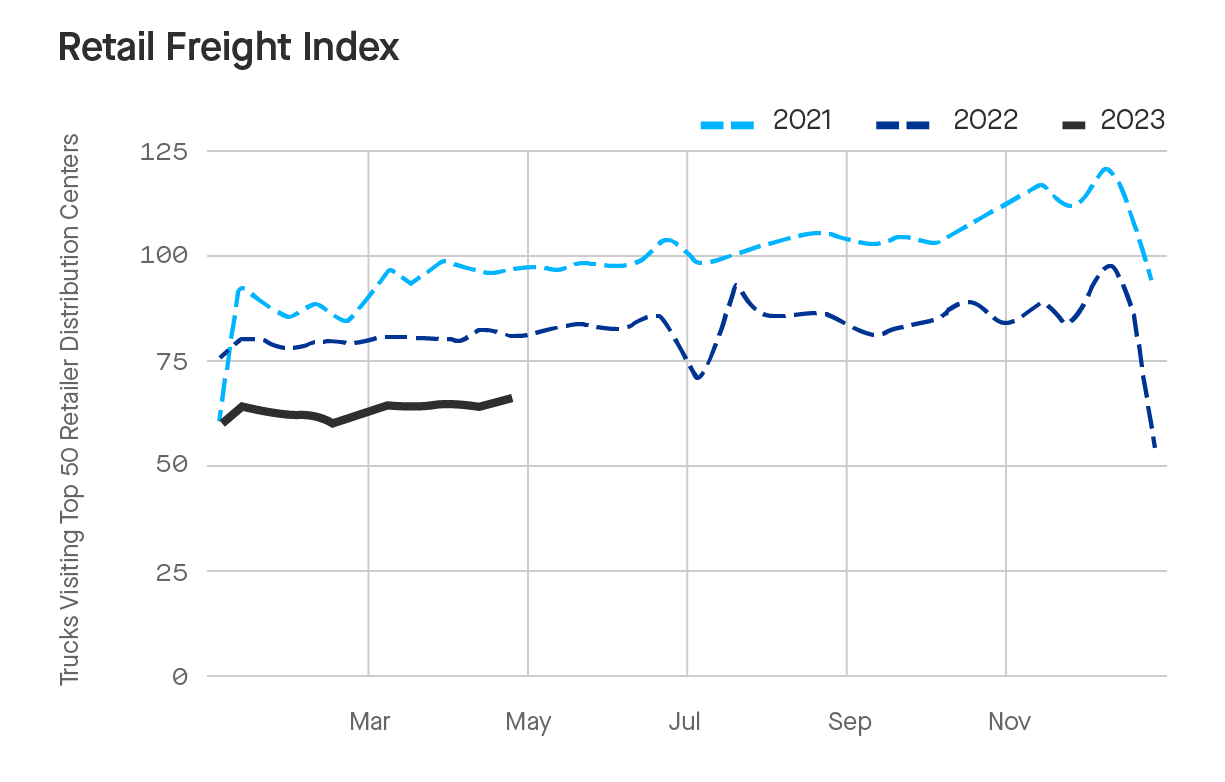

- In the retail sector, major distribution hubs are seeing more visits, but the top 50 retailers are not rushing to fill inventory as they have in previous years.

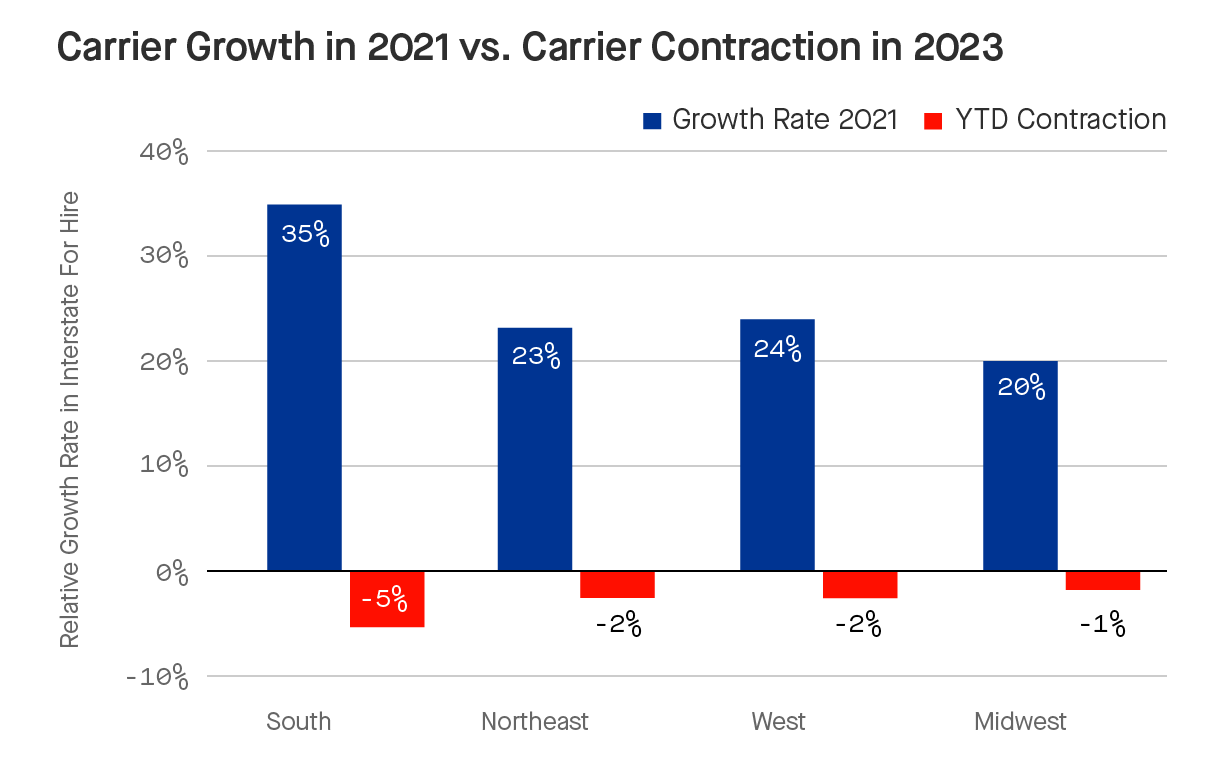

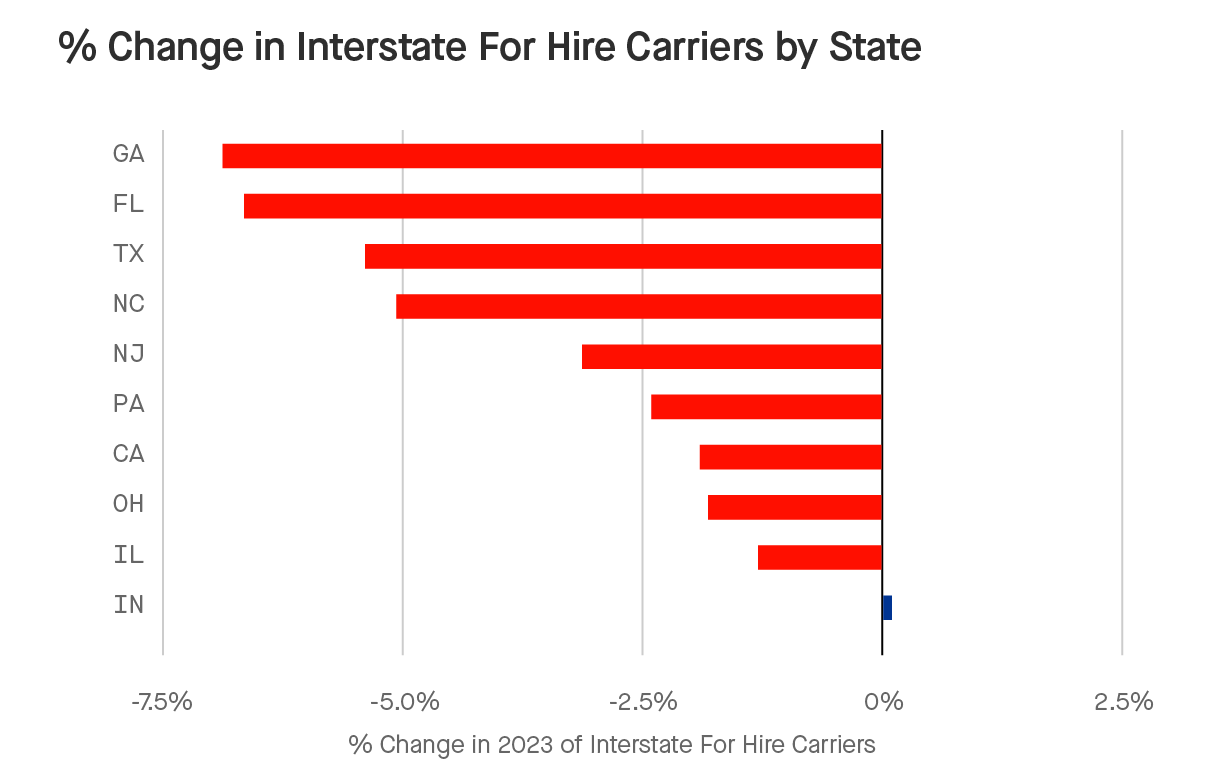

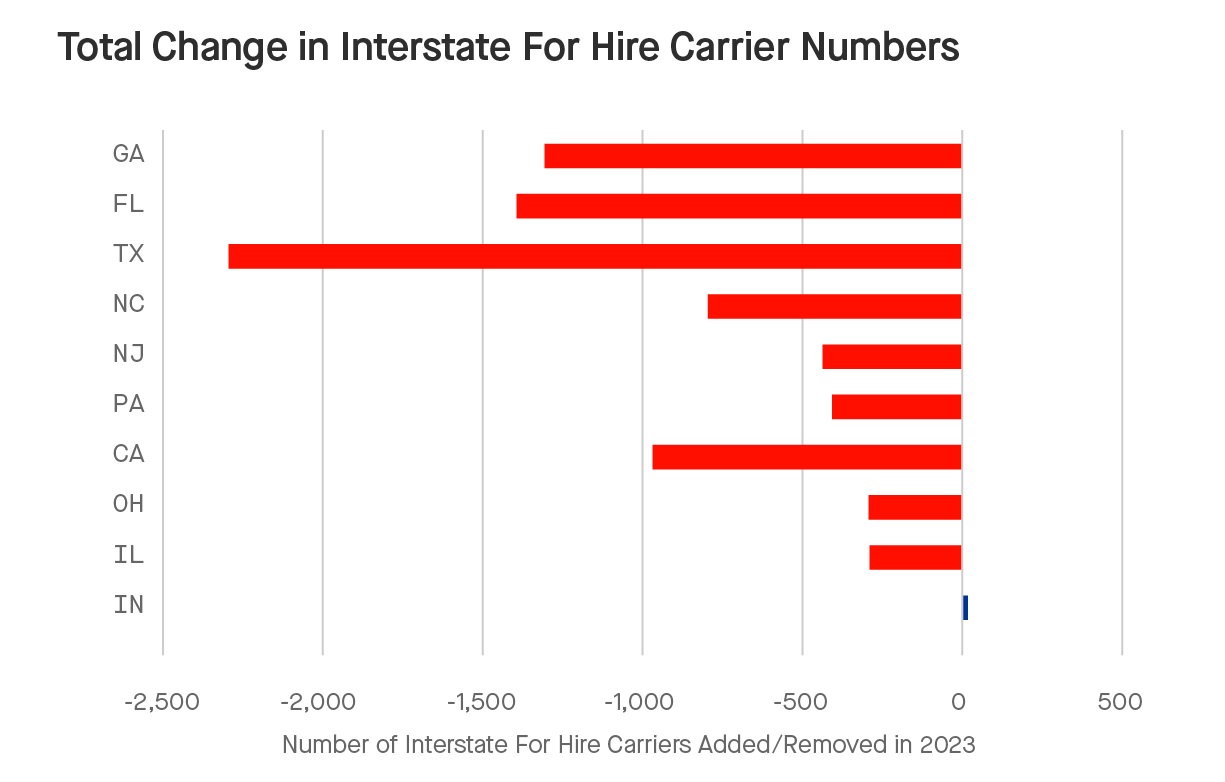

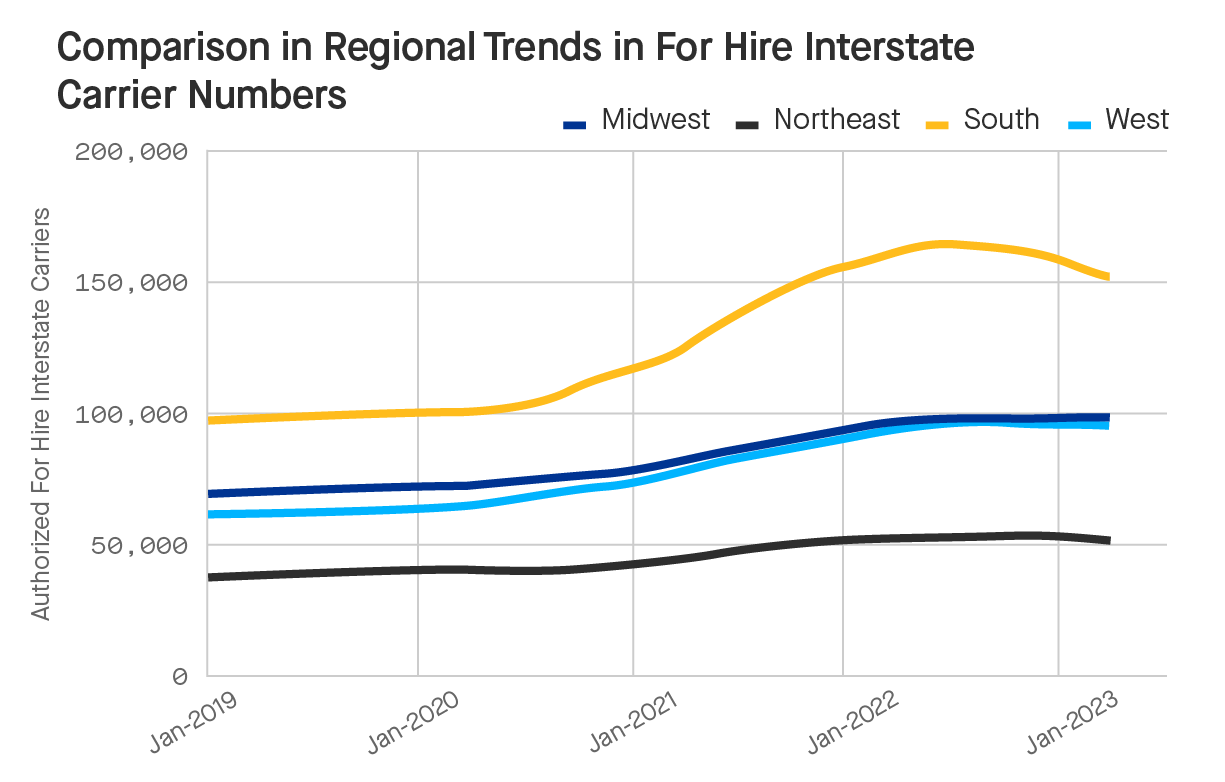

Regional view of market contraction shows the bigger the pandemic pop, the steeper the commensurate correction

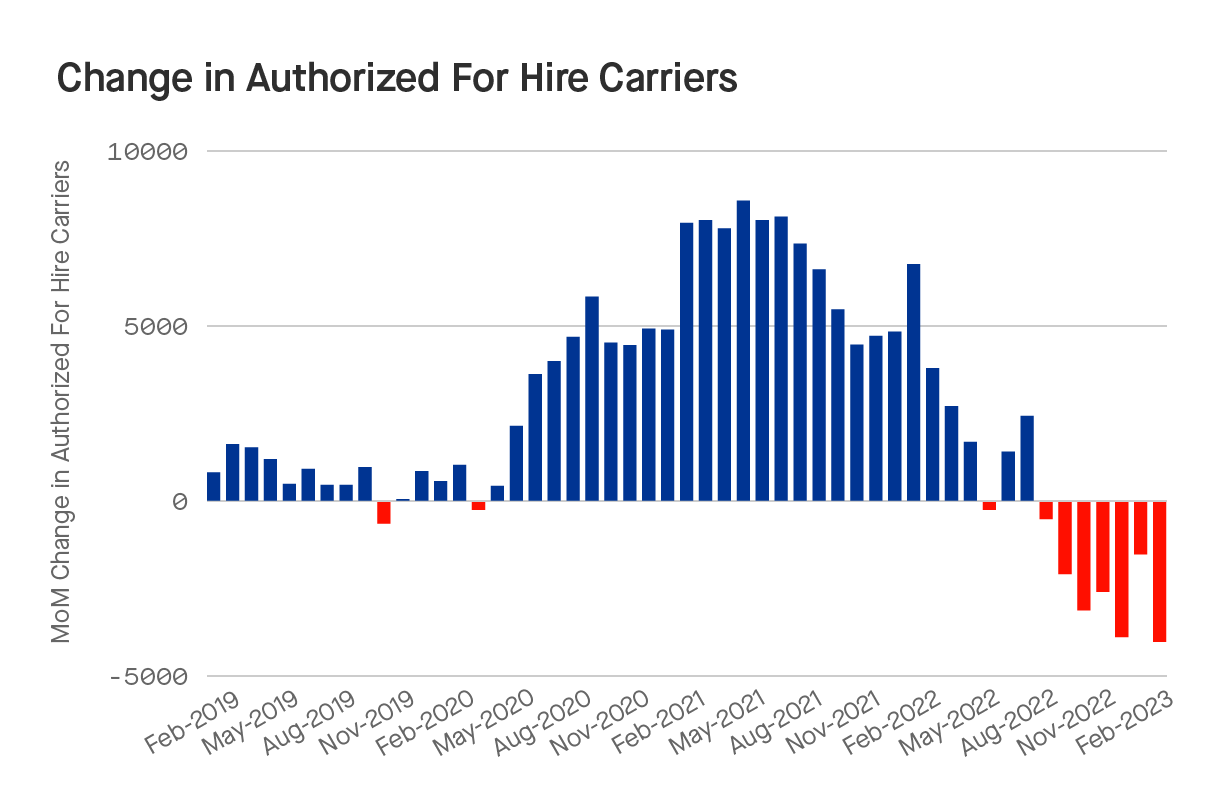

While the April data showed a sharper decline in the number of carriers nationwide compared to March (-4,000), new regional and state-level data show these losses were not even across the country. Southern states like Texas and Florida, which saw the largest gains during the industry’s pandemic highs, are seeing a similarly stark contraction. The ten states with the highest number of carriers all saw retraction with the exception of slight growth in Indiana. However, the fall across the overall market has not been precipitous, indicating the market may be moving toward more stability.

The freight market’s rebalancing continues

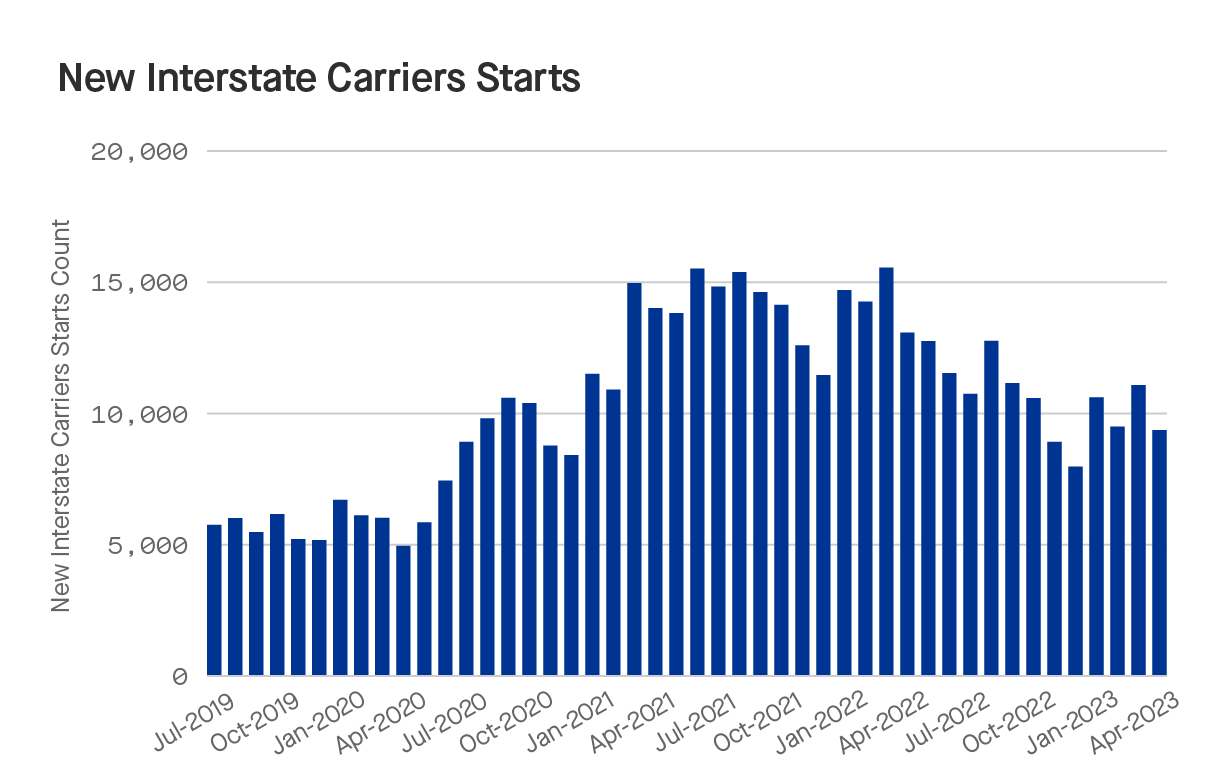

Despite new fleets being added in aggregate nationally, new company formations declined again in April, dropping 17% compared to March. The freight recession is continuing when compared to pandemic highs, but it’s likely more of a rebalancing given the fact that the 27% year-over-year industry growth seen in 2021 was almost quintuple the 10-year average of 5.6%. Carrier start data is also showing resilience, with starts remaining in line with the rolling six-month average. This indicates there are still businesses seeing enough opportunity to enter the market. It’s critical to monitor Q2 to see if the recession is indeed a recession or a reversion to the mean.

Top 50 retailers see more warehouse visits, but aren’t rushing to fill inventories

The top 50 retailers by revenue saw more visits to major distribution facilities in April, which is typical coming out of Q1. But unlike the past two years, retailers are not rushing to fill inventory, and this trend is expected to continue throughout Q2. This may mean that inventory purchasers have more modest expectations for the coming quarter, as consumer demand falls and supply chain health improves.

Key takeaway

Efficiency and flexibility are key as pandemic-related swings disrupted previous norms and retailers aren’t rushing to restock inventories. Some regions are seeing larger market swings. Therefore, carriers must take both a macro and localized approach to assess demand in real time.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration and U.S. Department of Transportation.