- The IFTA agreement saves trucking businesses millions of dollars every year and simplifies the process of redistribution of fuel taxes that interstate carriers pay.

- Interstate commercial carriers are required to file IFTA reports four times a year, even if they don’t drive outside the state or purchase taxable fuel in that quarter.

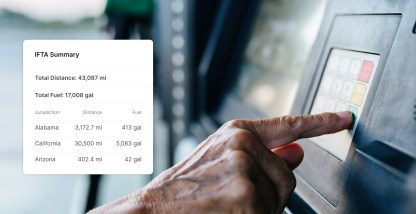

- Fleets can save up to multiple days per month of administrative work by using a fleet management software to automate IFTA reports.

To stay in business and remain compliant, a fleet must adhere to a number of rules and regulations that govern the roads. They include licensing, USDOT numbering, adherence to Hours of Service rules, material regulations, and the International Fuel Tax Agreement (IFTA).

IFTA is an agreement between states that simplifies redistribution of fuel taxes paid by interstate carriers.

How does IFTA work? Who needs to file IFTA fuel tax? What is the deadline for filing IFTA reports? Here’s what you need to know about IFTA.

What is IFTA?

IFTA pertains to the cooperative agreement between 48 states in the U.S. and 10 Canadian provinces. It allows inter-jurisdictional carriers to report and pay taxes for fuel consumption across states by using a single fuel tax license.

Why was the agreement necessary in the first place?

Prior to IFTA, truckers were required to obtain fuel permits from every state they entered. Not only was the process inefficient, but it also meant additional costs in the form of lost time, fuel burned en route to permit purchasing centers, and the applicable fees such as permits.

Fleets also had to comply with inconsistent filing periods, rules, definitions, and reporting requirements that involved hours of clerical work.

IFTA has established uniformity and efficiency in fuel tax payments among member states. According to estimates, IFTA saves trucking businesses millions of dollars annually in administrative costs.

All 10 Canadian provinces belong to the IFTA agreement. In the U.S., all states but Alaska and Hawaii belong to the agreement.

How does IFTA work?

The agreement ensures jurisdictions are properly compensated for the use of their roads by heavy commercial vehicles.

Under IFTA, carriers only need to report inter-jurisdictional fuel use to their base state. The state will collect the taxes on net fuel use, process fuel tax returns, and distribute the funds to all the other states.

The base state is also responsible for enforcing compliance through scheduled IFTA audits.

Who needs IFTA?

Carriers need an IFTA license if they’re based in a member state or operate across two or more member jurisdictions. They also need an IFTA license if they operate a qualified motor vehicle.

IFTA defines a qualified motor vehicle as one built and used to transport property or people. “Qualified motor vehicle” also may be defined in the following ways:

- Any vehicle with two axles and a gross vehicle weight of over 11,797 kilograms or 26,000 pounds

- A vehicle of any weight but with three or more axles

- A vehicle that exceeds 11,797 kilograms or 26,000 pounds

How to apply for IFTA license and decals

If you need an IFTA license, the first step is to fill out the application form used in your base state.

IFTA application forms may be used in several ways. Carriers based in Ohio, for example, can use the IFTA application form to request additional decals or make changes to their accounts.

Basic carrier information required for new IFTA applications include a registered business name, a mailing address, a federal business number, and a USDOT number.

If downloaded online, completed IFTA forms can be sent by mail. Other jurisdictions also allow IFTA forms to be sent by fax or through taxpayer service offices.

Once your application has been processed, the IFTA authority in your state will issue official IFTA decals for the current year. A temporary IFTA license can be sent to you by fax while you wait for your decals.

What are the IFTA requirements?

To obtain an IFTA license, a fleet will have to fulfill the below requirements for IFTA.

- Register a base state. You can do that by contacting the local register. For more information, click here.

- You will have to obtain an IFTA license for qualified vehicles.

- You can apply for an IFTA license in your base jurisdiction by filling out the application form. After that, you will receive two decals, to be placed on either door, and a license for each vehicle. These must be renewed annually.

- A fuel tax report needs to be filed quarterly, even if you don’t drive outside the state or purchase taxable fuel. Here are the deadlines.

- First quarter: April 30

- Second quarter: July 31

- Third quarter: Oct. 31

- Fourth quarter: Jan. 31

- To receive any refunds or tax credits, you will need fuel receipts or invoices. These receipts must contain the following information.

- Seller’s name and address

- Purchaser’s name

- Unit number of the vehicle

- Type of fuel purchased

- Number of gallons purchased

- Price per gallon

- Apart from the fuel receipts, you will also need to maintain records of individual trip reports for audit purposes for up to four years.

How to file quarterly IFTA taxes

The process of filing quarterly IFTA taxes can be summarized in five simple steps.

Step 1: Track miles you’ve traveled in each state

Fleet managers and drivers must work together to accurately record the amount of fuel consumed in different jurisdictions. Drivers must also do their part and diligently record odometer readings whenever they cross state lines.

To avoid human error and mistakes while filing IFTA fuel tax reports, you can leverage route planning or fleet management software to digitally log the miles covered for each jurisdiction. We will discuss more about it later in the article.

Step 2: Add fuel purchases

For IFTA fuel tax reports, you’ll also need to know the total gallons of fuel purchased in each jurisdiction.

Remember, carriers must retain the original receipts or invoices to prove that fuel tax was paid.

Step 3: Calculate fuel consumed per state

Once you have the total miles and fuel purchased tallied, it’s time to calculate the fuel mileage of your vehicles for each jurisdiction. You can use the simple formula below to calculate your fleet’s overall fuel mileage.

Total miles driven / Total gallons = Overall fuel mileage

For example, if you purchased 4,000 gallons of fuel and covered 22,000 miles, then your overall fuel mileage would be calculated this way.

22,000 / 4,000 = 5.50 miles per gallon

Be sure to round off the MPG value to two decimal places.

To calculate how many gallons your fleet consumed in each jurisdiction, input your overall fuel mileage to the formula below.

Total miles driven in State X / Overall fuel mileage = Fuel consumed in State X

Keep in mind that you need to use the second equation for each state or province you operated in during the current reporting period.

Step 4: Calculate taxes owed for each state and province

The fuel purchased per jurisdiction is the key metric needed to calculate the fuel tax amount your fleet owes each jurisdiction. This is dependent on the applicable rates during the current IFTA quarter.

You can view the complete chart of fuel tax rates for each fuel type and jurisdiction on the International Fuel Tax Association website. Understand that rates could change before the next due date. You don’t have to perform this calculation until then.

Step 5: Put it all together

Finally, you can use the formula below to calculate the actual tax amount you owe each state.

Fuel tax required in state X – Fuel tax paid in state X = Fuel tax owed to state X

You can determine the amount of fuel tax paid upon purchase from fuel receipts or fuel withdrawal slips.

3 things to remember when filing IFTA taxes

The formulas above skip certain aspects of IFTA tax reporting. Use them with discretion and be prepared to make adjustments, especially once fuel tax rates are finalized by the end of every IFTA quarter.

Important aspects to remember when filing quarterly IFTA taxes include the information below.

- Taxable miles

Your fleet’s total taxable miles is usually the same as the total miles driven in each jurisdiction. However, certain jurisdictions allow mileage exceptions that do not count as taxable, such as fuel trip permit miles.

- Taxable gallons consumed

To calculate your vehicle’s taxable gallons consumed, divide your total taxable miles by your overall fuel mileage. You can then subtract your total tax for paid gallons purchased to get your net taxable gallons.

- Surcharges

Surcharges allow a state where fuel is purchased to keep a portion of the money regardless of where the fuel is used. Fleets should only purchase the amount of fuel they expect to use within jurisdictions where surcharges apply.

How to file IFTA reports with Motive

Doing everything manually can be an administrative burden. Drivers and fleet managers must manually track their vehicle miles and fuel purchases when filing quarterly IFTA taxes. Everything from fuel purchase receipts to a list of miles driven in each jurisdiction must be accounted for.

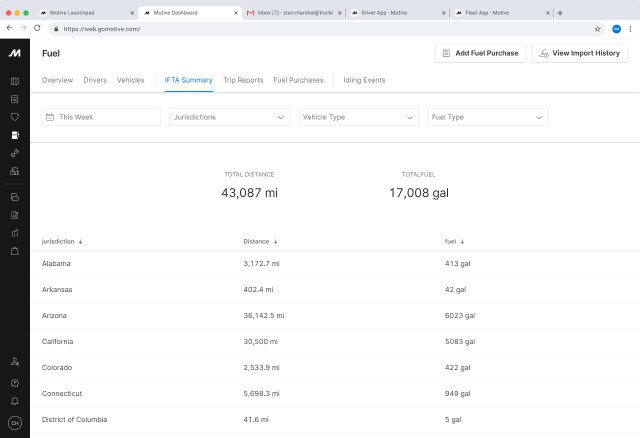

Motive can help automate this entire process for consistent IFTA reports.

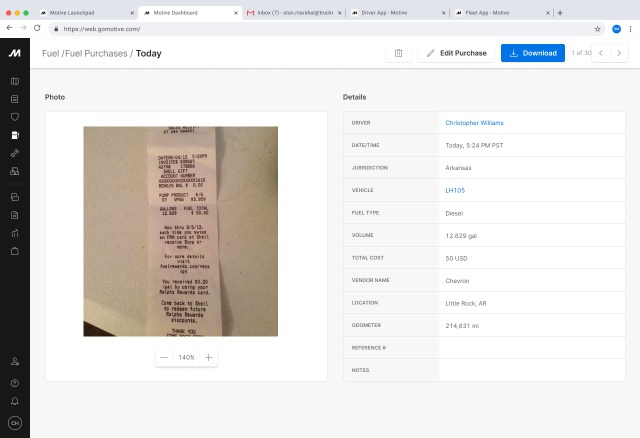

Drivers can easily upload fuel purchases at the point of purchase to the Motive Dashboard. Just have them take a photo of the fuel receipt and fill out the required information, including location, cost, and fuel type.

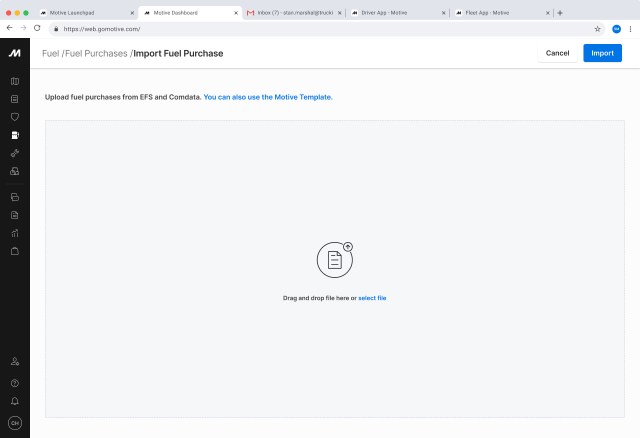

Fuel receipts can be uploaded individually or be imported in bulk. If you use Comdata or EPS as your fuel card providers, you can download a .CVS file of your fuel purchase history and upload it to Motive via bulk import.

With all fuel receipts in one place, you can save hours of administrative work each quarter by preparing IFTA reports in just a few clicks.

IFTA FAQs

Filing quarterly IFTA taxes can be a challenge despite the availability of tools that expedite reporting. To make it more manageable for your fleet, here is a short roundup of IFTA-related frequently asked questions.

- Do I need to file IFTA taxes if I didn’t move any freight?

Yes — filing quarterly IFTA taxes is required even if your fleet was inactive during the reporting period.

- What if we never went beyond our base state for the entire quarter?

You are required to file your quarterly IFTA report even if you didn’t operate outside your jurisdiction for a given quarter.

New decals will be supplied to your fleet whenever you renew your IFTA license, which is done annually. In case you lost or damaged your IFTA decals, you can send a request to your jurisdiction’s IFTA authority and order new ones.

- What if an intrastate fleet is suddenly required to operate out of state?

For one-time trips between two or more jurisdictions, fleets can use temporary trip permits. They are only valid for one vehicle on a specific journey into another jurisdiction.

To acquire a single-trip permit, the carrier must define the time period and the total distance to be covered. This information will be used to calculate the fuel tax to be paid along with other applicable fees.

- What are the penalties for failing to file or pay an IFTA quarterly return?

If a carrier fails to file a quarterly IFTA return, they have 30 days to complete the requirements before their license gets suspended.

Late payments are subject to a penalty of $50 or 10% of the total tax due, whichever is higher.

Simplify IFTA reporting with modern technology

Fuel tax preparation can be tedious, but once you understand what IFTA is and how everything is done, it will be easier to tackle.

IFTA eliminates the messy fuel tax reporting practices of old. It also enables jurisdictions to fund road repairs and improvements, which will directly impact the safety of commercial fleets on the road.

Although IFTA fuel tax calculation and reporting can be overwhelming, you can use the Motive fleet management solution to simplify the process of calculating quarterly IFTA reports.